Understanding Modern Payment Plugin Solutions for Websites

Online businesses rely heavily on secure and efficient payment processing systems. As digital commerce continues to grow, developers and website owners look for reliable tools to manage transactions safely. A good payment integration system not only supports customers but also improves operational efficiency.

Payment plugins act as bridges between websites and financial networks, allowing automated transaction handling without complex coding. They help reduce manual processing errors and improve checkout speed.

Choosing the right payment solution depends on security features, compatibility, and development flexibility. Modern businesses prefer lightweight and scalable tools that work across different content management systems.

A strong example of payment technology development is provided by Volet, which focuses on developer-friendly financial integration solutions.

What Is a Payment Plugin?

Definition and Purpose

A payment plugin is a software extension that enables websites to accept online payments. It connects customer checkout interfaces with payment gateways, ensuring smooth fund transfers.

These plugins are commonly used in eCommerce stores, subscription platforms, and digital service marketplaces. They reduce development complexity by providing ready-made transaction workflows.

Key purposes of payment plugins include:

- Secure transaction processing

- Automated payment confirmation

- Multi-currency support

- Fraud prevention mechanisms

Businesses benefit from faster deployment since developers do not need to build payment systems from scratch.

How Payment Plugins Work

Payment plugins function by communicating between three main components:

- Customer browser interface

- Website backend server

- Payment gateway network

When a customer completes checkout, the plugin encrypts transaction data. The gateway then verifies payment details before sending confirmation signals.

Modern plugins also support tokenization, which replaces sensitive financial data with secure digital tokens. This improves safety and reduces cyber risk.

Read More: FintechZoom Ultimate Guide: Mastering Finance, Crypto, Banking, and Digital Innovation

Importance of Payment Plugins for Modern Websites

Improving Customer Experience

Customers prefer websites where checkout is quick and simple. Complicated payment processes often lead to cart abandonment.

Payment plugins provide:

- One-click checkout options

- Saved payment methods

- Mobile-friendly transaction interfaces

Faster payment processing builds customer trust and encourages repeat purchases.

Enhancing Business Security

Cybersecurity is a major concern in digital commerce. Payment plugins help protect sensitive financial information through encryption technologies.

Security advantages include:

- SSL/TLS data protection

- Real-time fraud monitoring

- Secure authentication protocols

Website owners can operate confidently knowing customer information remains protected.

Read More: Why E-commerce Affiliate Software Is Vital for Conversion Tracking

Features of a High-Quality Payment Plugin

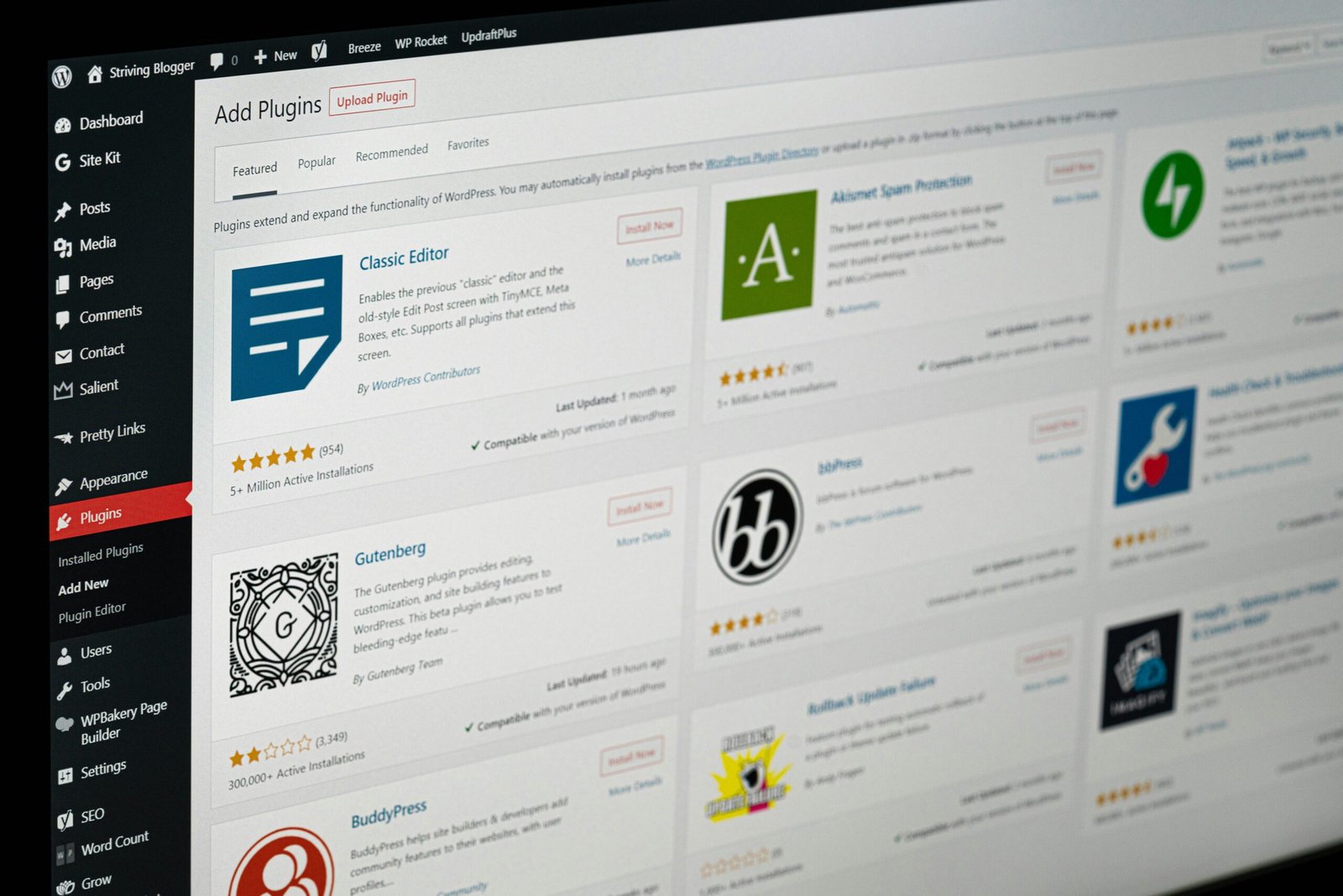

Multi-Platform Compatibility

Modern payment plugins must support different platforms such as WordPress, Shopify-style systems, and custom CMS frameworks.

Developers prefer flexible solutions that allow easy integration without rewriting website architecture.

Compatibility also ensures businesses can scale operations across multiple online channels.

Developer-Friendly API Support

Application Programming Interfaces (APIs) are essential for customization.

Good plugins offer:

- Documentation resources

- Sample code integration

- Testing environments

- Webhook notification systems

These features help developers build personalized payment workflows.

Benefits of Using Payment Plugins

Faster Transaction Processing

Manual payment verification can slow down business operations. Automation reduces waiting time for both customers and merchants.

Real-time processing ensures:

- Instant order confirmation

- Reduced administrative workload

- Improved service delivery speed

Speed is a critical factor in competitive online markets.

Global Business Expansion

Many websites now target international customers. Payment plugins support:

- Multiple currencies

- International banking networks

- Cross-border transaction systems

This capability allows small businesses to enter global markets.

Cost Efficiency

Developing custom payment infrastructure is expensive.

Using reliable plugins helps businesses save:

- Development time

- Maintenance costs

- Security management expenses

Subscription-based plugin models are often more economical.

Technical Considerations When Choosing a Payment Plugin

Security Standards

Always check whether the plugin follows industry security standards.

Important certifications include:

- PCI DSS compliance

- Advanced encryption protocols

- Secure authentication systems

Security should be the primary selection factor.

Performance Optimization

Poorly designed plugins can slow down website loading speed.

Performance considerations include:

- Lightweight code architecture

- Efficient database queries

- Minimal server resource consumption

Fast websites rank better in search engines and improve user satisfaction.

Customer Support Availability

Technical problems may arise during integration.

Choose solutions that provide:

- Developer support channels

- Community forums

- Regular software updates

Reliable support reduces operational risk.

Payment Plugin Integration Challenges

Compatibility Issues

Some websites use custom frameworks that may not support standard plugins.

Developers may need to:

- Modify backend configurations

- Write middleware connectors

- Test transaction flows carefully

Proper planning prevents integration failure.

Security Vulnerabilities

Outdated plugins may create security gaps.

Regular updates are essential to protect against:

- Malware attacks

- Data breaches

- Unauthorized access attempts

Website administrators should monitor plugin health continuously.

Future Trends in Payment Plugin Technology

Artificial Intelligence Integration

AI technologies are improving fraud detection systems.

Smart algorithms analyze:

- User behavior patterns

- Transaction anomalies

- Risk scoring metrics

This reduces fraudulent activities significantly.

Blockchain Payment Systems

Decentralized finance technologies are becoming more popular.

Blockchain-based plugins offer:

- Transparent transaction records

- Lower transfer fees

- Improved trust mechanisms

Many developers are experimenting with distributed ledger technology.

Voice and Mobile Commerce Support

Voice assistants and mobile applications are shaping future commerce.

Payment plugins are evolving to support:

- Voice-activated purchases

- Wearable device payments

- One-touch mobile authentication

Best Practices for Website Owners

- Always test plugins in development environments.

- Maintain regular backup systems.

- Monitor transaction logs frequently.

- Update security patches immediately.

- Choose scalable payment infrastructure.

Following these practices ensures long-term operational stability.

Conclusion

Payment plugins are essential components of modern digital business ecosystems. They simplify transaction management, improve customer experience, and enhance website security. Choosing a reliable solution ensures smooth financial operations and supports business growth.

Developers and business owners should focus on security, performance, and compatibility when selecting integration tools. Advanced payment technology continues to evolve, offering smarter automation, global connectivity, and stronger fraud protection mechanisms.

By adopting professional payment integration solutions, websites can deliver faster, safer, and more convenient purchasing experiences for users worldwide.

FAQs

1. What is a payment plugin used for?

A payment plugin allows websites to accept and process online payments automatically. It connects checkout systems with payment gateways and supports secure financial transactions. Businesses use these tools to simplify eCommerce operations and improve customer convenience.

2. Are payment plugins safe for online businesses?

Yes, reliable payment plugins follow strict security standards such as encryption protocols and PCI compliance. They protect customer financial information from cyber threats and unauthorized access, making online transactions safer.

3. Can payment plugins work on custom websites?

Many modern plugins support custom websites through API integration. Developers can configure payment workflows according to business needs, although technical expertise may be required for advanced customization.

4. Do payment plugins support international transactions?

Most professional payment plugins support multiple currencies and international banking systems. This feature helps businesses reach global customers and expand their online market presence effectively.

5. How do I choose the best payment plugin?

Consider security certification, performance speed, compatibility with your CMS, developer support, and transaction fees. Testing the plugin before live deployment is also recommended for smooth operation.